The 2026 IRS income tax refund schedule is drawing strong attention as millions of Americans depend on refunds to manage rising living costs. In earlier years, tax refunds were often treated as extra money. In 2026, they play a much bigger role in household financial planning. Inflation, higher rent, medical expenses, and everyday bills have made refund timing just as important as the refund amount itself.

Why the 2026 Tax Season Feels Different

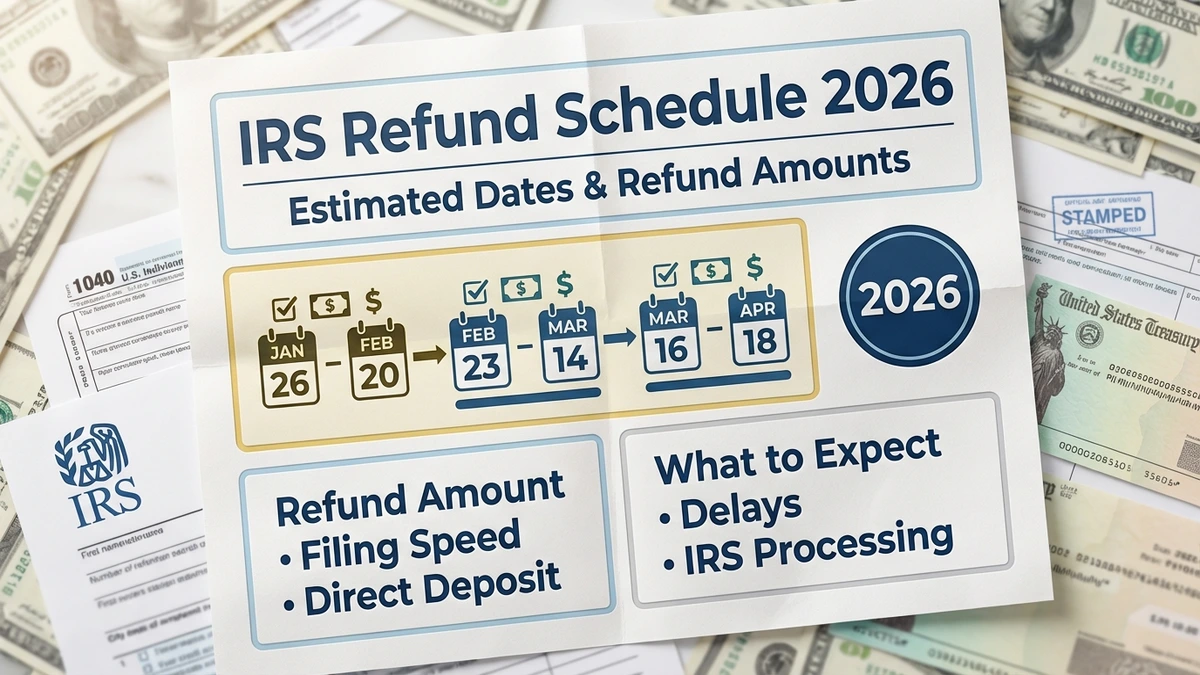

The 2026 tax filing season officially opens in late February, and while the filing deadline still falls in mid-April, the process behind the scenes has changed. The Internal Revenue Service has upgraded its systems to improve accuracy and reduce fraud. These updates mean tax returns are now checked more carefully against income records from employers, banks, and other reporting agencies.

How Refund Processing Works in 2026

Once returns begin arriving, the IRS processes them in the order received. In the past, many taxpayers received refunds within 10 to 21 days if they filed electronically and chose direct deposit. That timeline still exists, but it is no longer guaranteed. Refund speed now depends heavily on whether all income information matches official records rather than simply how early a return is filed.

Early Filing Can Still Face Delays

Filing early has long been considered the best way to get a refund faster. In 2026, early filing comes with some risk. Employers and financial institutions may not have submitted all income data when early returns are filed. If there is a mismatch, the IRS system may pause processing until the information is confirmed, even if the return appears correct.

Credits That Affect Refund Timing

Certain tax credits continue to delay refunds by law. Returns that include credits related to work income or dependent children are held until at least mid-February. This rule applies every year and remains in effect for 2026. Many families should expect refunds in late February or early March, even if their return is accurate.

Shift to Fully Digital Refunds

One major change in 2026 is the complete move away from paper checks. All refunds are issued electronically through direct deposit or approved digital payment methods. This change is intended to improve security and reduce delays caused by mail issues. Taxpayers without bank accounts may receive refunds through prepaid cards or digital alternatives.

Common Reasons Refunds Are Delayed

Mistakes such as incorrect bank details, dependent information errors, or inconsistent income reporting can still slow refunds. Returns involving self-employment income or multiple income sources often take longer to process due to additional checks.

What This Means for Taxpayers

The 2026 refund system prioritizes accuracy over speed. While this can feel frustrating, careful filing and realistic expectations can reduce stress. Planning finances without relying on a specific refund date is becoming more important than ever.

Disclaimer

This article is for informational purposes only and does not provide tax, legal, or financial advice. IRS refund schedules, processing times, and rules may change based on official updates. Readers should consult the Internal Revenue Service or a qualified tax professional for guidance specific to their situation.