As February 2026 continues, talk of a $2,000 direct deposit has once again spread widely across the United States. Social media posts and online videos have raised hopes among families struggling with higher grocery prices, rent increases, insurance costs, and medical bills. When money is tight, even the possibility of extra financial support can feel significant. Still, it is important to understand what is actually happening and what is being misunderstood.

Why the $2,000 Figure Is Getting Attention

The number $2,000 carries strong emotional meaning because of past stimulus payments issued during earlier economic crises. Those payments were real and helpful, so many people now associate similar amounts with new government relief. When bank deposits close to $2,000 appear, it is easy to assume that a new payment program has been approved, even when that is not the case.

No New Nationwide Payment for February 2026

There is no newly announced universal payment tied specifically to February 2026. Neither Congress nor the Internal Revenue Service has approved a new stimulus or relief program. Claims suggesting a guaranteed $2,000 deposit for everyone are not accurate. Instead, most deposits around this amount are linked to existing systems that have been in place for years.

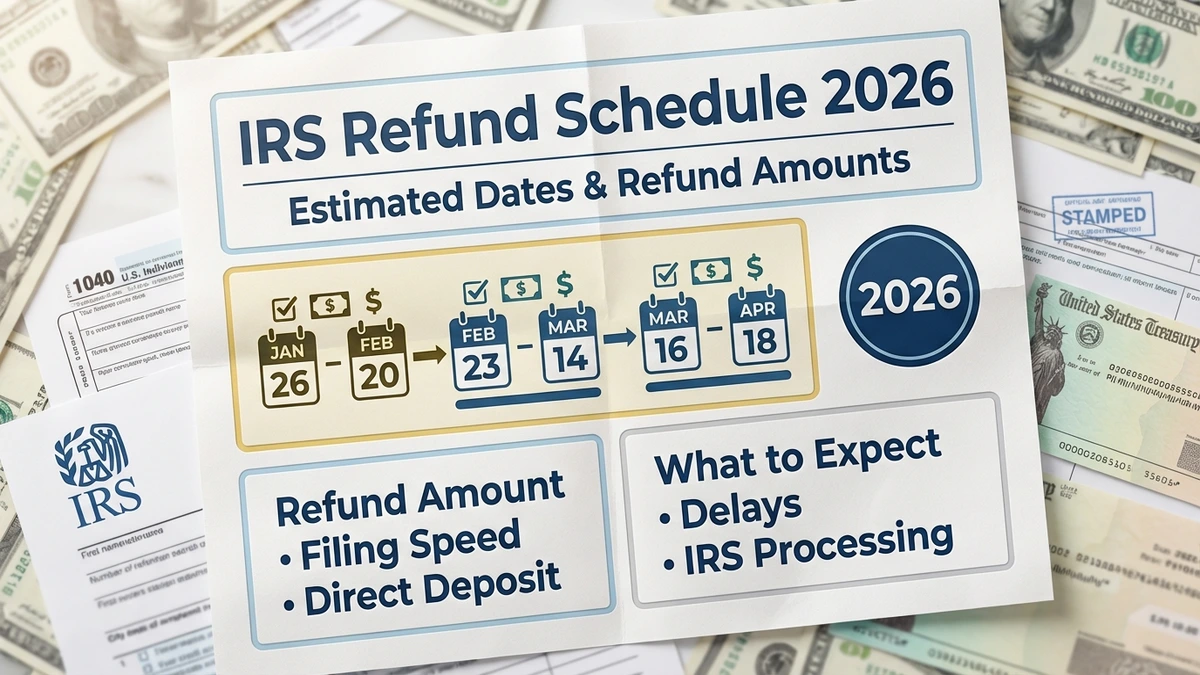

The Role of Tax Refunds in February

February is one of the busiest months for tax refunds, especially for early filers. When people file their tax returns electronically and choose direct deposit, refunds often arrive quickly. Refundable credits such as the Earned Income Tax Credit and Child Tax Credit can significantly increase refund amounts. When combined with overpaid taxes, refunds can easily reach or exceed $2,000, which often leads to confusion online.

Federal Benefits and Payment Timing

Federal benefit programs also add to the misunderstanding. Social Security, SSI, SSDI, and veterans’ benefits are paid on fixed schedules throughout the year. Depending on benefit type and personal history, some monthly payments can approach $2,000. Calendar changes caused by weekends or holidays can shift deposit dates earlier, making payments feel unexpected even though the amount has not changed. These benefits are managed by agencies such as the Social Security Administration.

Why Expectations Often Don’t Match Reality

Online estimates often ignore income limits, partial credits, or deductions such as unpaid federal obligations. As a result, people may expect a full $2,000 but receive less once official calculations are completed. Federal payment amounts are based on laws and eligibility rules, not online trends or viral posts.

Avoiding Misinformation and Scams

False claims about payments also attract scammers. Government agencies do not send unsolicited messages asking for personal details or fees to release money. Relying on unofficial sources can lead to disappointment or financial harm.

Understanding What February Really Means

February 2026 does not signal a new nationwide payment. Instead, it highlights how tax refunds and benefit programs continue to support millions of Americans quietly and consistently. Any real change in federal payment policy would be clearly announced through official channels.

Disclaimer: This article is for informational purposes only and does not provide financial, legal, or tax advice. Federal payment amounts, eligibility rules, and timelines are determined by law and official government agencies and may vary by individual circumstances. Readers should rely on official updates from the IRS, the Social Security Administration, the Department of Veterans Affairs, or other relevant government sources for accurate and current information.