The 2026 tax filing season has begun in the United States, and many taxpayers are closely watching their refund status. For a large number of families, a tax refund is not just extra income. It often helps cover rent, reduce debt, pay utility bills, or handle everyday expenses. Understanding how the refund process works and what can affect the timeline helps taxpayers plan better and avoid unnecessary worry.

How the IRS Processes Tax Returns

After a tax return is submitted, it goes through several review steps before a refund is issued. If the return is filed electronically, the Internal Revenue Service usually confirms receipt within about a day. The system then checks income records, verifies personal details, and reviews any tax credits claimed. If everything matches and no problems are found, the refund is approved and scheduled for payment.

Paper returns follow a slower path because they must be opened, scanned, and entered manually. This additional handling means refunds from paper filings often take significantly longer than those filed electronically.

Filing Method and Refund Speed

The way a taxpayer files has a strong effect on how quickly a refund arrives. Electronic filing with direct deposit is generally the fastest option and may result in payment within two to three weeks if the return is accurate. Choosing a mailed check instead of direct deposit adds time because of printing and postal delivery. Filing a paper return, especially with a mailed check, is usually the slowest method and may take six weeks or longer during busy periods.

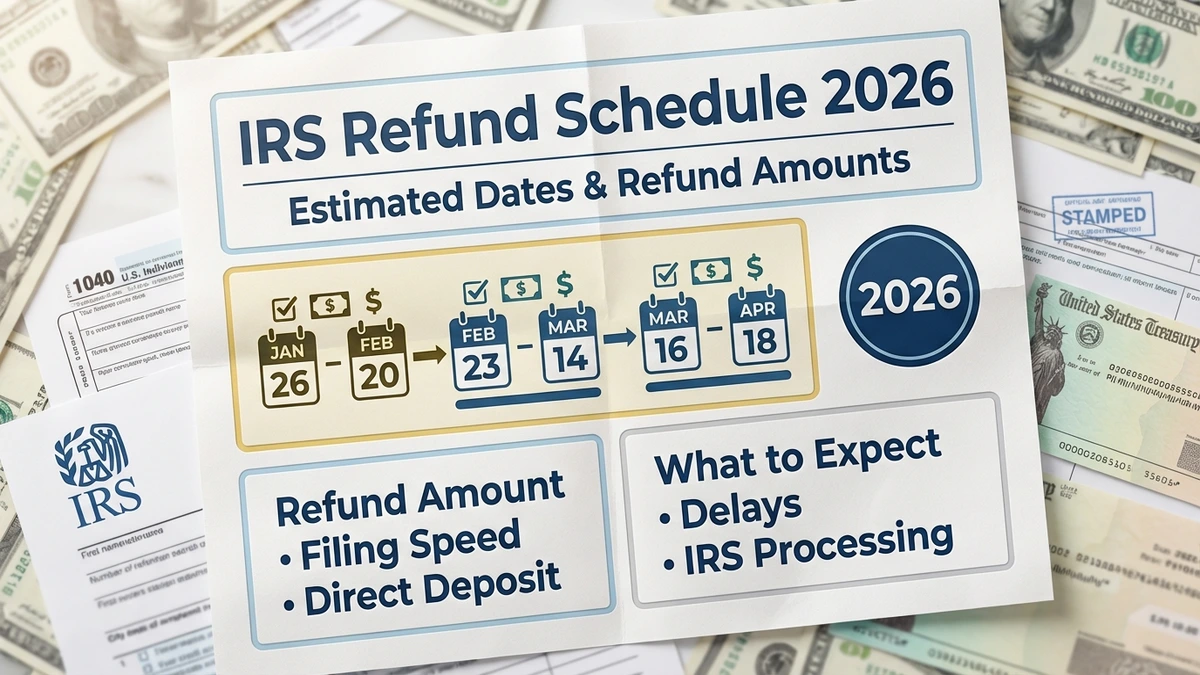

When Refunds May Arrive

Taxpayers who file in late January or early February and provide complete and accurate information may receive refunds during February. Some deposits arrive in the first half of the month, while others are issued closer to the end. It is important to remember that the refund timeline begins when the IRS accepts the return, not when it is first submitted.

Reasons Refunds Can Be Delayed

Certain tax credits require additional review, which can delay refunds. Returns claiming the Earned Income Tax Credit or Additional Child Tax Credit are often held until mid-to-late February or later due to verification rules. Other delays can occur because of simple errors, such as incorrect Social Security numbers, mismatched income figures, or inaccurate bank details. In some cases, identity verification requests or missing documents may also slow processing.

Tracking Refund Status

Taxpayers can track refunds using the IRS online status tool, which shows whether a return has been received, approved, or sent. Even after a refund is sent, banks may take a few days to post the funds.

Planning for a Smoother Tax Season

Filing early, choosing electronic filing with direct deposit, and carefully checking all information before submission remain the best ways to receive a refund as quickly as possible. Although many refunds are issued within about three weeks, timelines can vary, and patience is sometimes necessary.

Disclaimer: This article is for general informational purposes only. Tax rules, refund timelines, and eligibility requirements may change and can vary by individual situation. Readers should refer to official IRS resources or consult a qualified tax professional for accurate guidance.