As the 2026 U.S. tax season moves forward, millions of taxpayers are closely checking their refund status. For many households, a tax refund is not simply extra income but an important financial resource used to manage rent, groceries, healthcare, and other daily expenses. Because living costs remain high, knowing when a refund may arrive has become more important than ever, especially during February, which is usually one of the busiest months for early refund payments.

Why February Is Important for Tax Refunds

February plays a major role in the tax season because it includes many of the first refunds issued to early filers. Taxpayers who submit their returns as soon as electronic filing opens often expect faster processing. In 2026, a large number of people filed early due to ongoing financial pressure, increasing interest in refund timelines.

How the IRS Processes Refunds

Once a tax return is electronically filed and accepted, it enters a review system operated by the Internal Revenue Service. The system checks reported income, tax credits, and withholding amounts to ensure everything matches official records. If no issues are found, the refund is approved and scheduled for payment. Taxpayers who choose direct deposit usually receive funds faster than those who request paper checks.

Paper returns generally take longer because they must be handled manually. Even small mistakes, such as missing details or unclear entries, can delay processing, which is why electronic filing is strongly recommended.

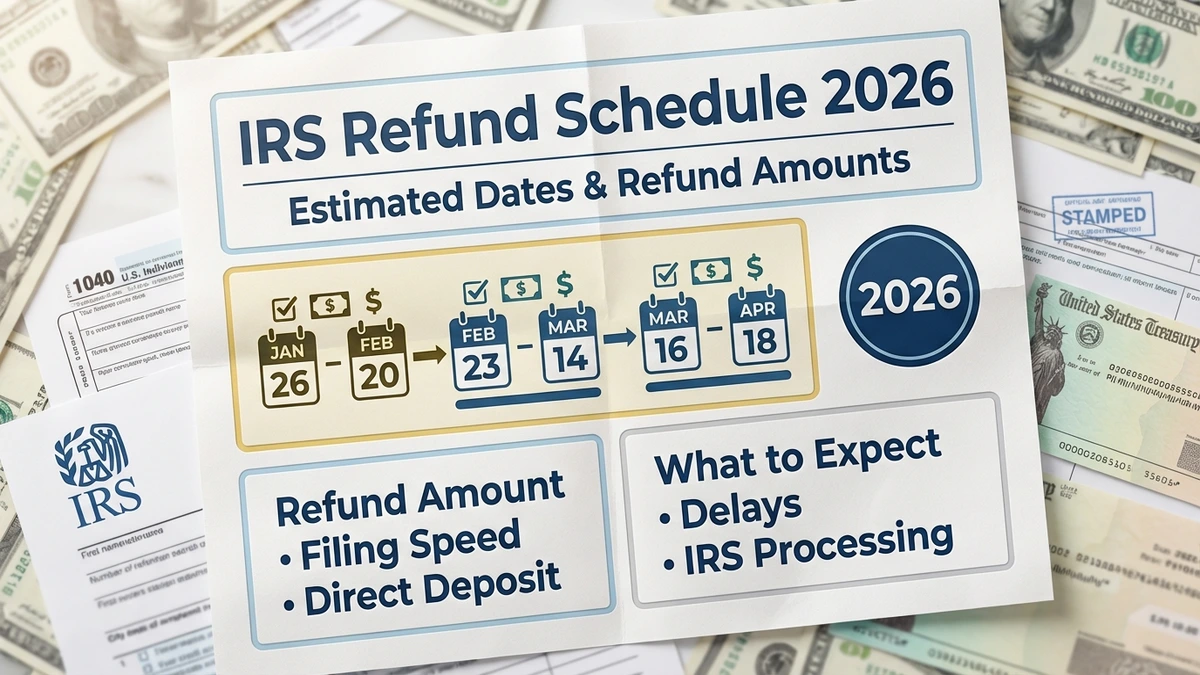

Estimated Refund Timing in February 2026

Taxpayers who filed electronically in late January 2026 and selected direct deposit may begin receiving refunds in early February. Many of these payments are expected during the first or second full week of the month. Returns filed in early February often result in refunds by mid-to-late February, provided there are no complications.

However, refunds that include certain refundable credits may take longer. These returns often require additional checks, which can push payment dates toward the end of February or into early March.

Common Reasons for Refund Delays

Refund delays often occur because of incorrect bank account numbers, mismatched personal information, or simple calculation errors. Identity verification requests have also increased, which can add extra processing time. Returns involving amended filings or income differences reported by employers may require manual review, which extends the timeline.

Why Refund Timing Matters to Families

For many households, tax refunds help pay winter bills, reduce debt, or rebuild savings. When refunds arrive on time, families experience some financial relief. When delays happen, people may rely more heavily on credit, increasing financial pressure. Refund timing also affects local economies, as billions of dollars flow into communities each February.

Tracking Refund Status Safely

Taxpayers can monitor progress using official IRS tracking tools, which show whether a return is received, approved, or sent. These updates are more reliable than unofficial online schedules or rumors.

February remains a key month for refunds, especially for early filers. While many refunds are issued quickly, some delays are normal, and understanding the process helps reduce uncertainty.

Disclaimer: This article is for informational purposes only and is based on general IRS practices and historical refund patterns. Actual refund dates may vary depending on individual tax situations, filing accuracy, and IRS processing requirements. Readers should consult official IRS resources or a qualified tax professional for personalized advice regarding tax refunds.