Discussions about a possible $2,000 IRS direct deposit have become widely talked about as February 2026 continues. Many households are paying close attention because everyday expenses such as groceries, rent, transportation, and heating remain high. Even the possibility of short-term financial help has created interest, especially among families managing tight budgets. However, it is important to understand what is confirmed and what is still only part of policy discussions.

What the $2,000 Direct Deposit Refers To

The proposed payment is described as a one-time relief measure rather than a tax refund. A tax refund returns money that was overpaid during the year, while this payment is intended to provide temporary assistance during a period of high living costs. It is also not designed as a loan, meaning recipients would not be expected to repay it. The goal discussed in policy conversations is to provide limited support rather than create a long-term benefit program.

Why the Proposal Is Being Discussed

Economic conditions have played a major role in bringing attention to this idea. Inflation has slowed compared to earlier peaks, but many households still feel pressure from housing costs, insurance, and food prices. Winter months often increase expenses because of heating bills and seasonal costs. Policymakers are trying to balance these concerns with worries about inflation and government spending, which is why any proposed payment is being discussed cautiously.

How Eligibility Could Be Determined

If approved, eligibility would likely be based on recent tax filings. The Internal Revenue Service already holds income records, filing status, and banking details for many taxpayers, which could allow payments to be issued automatically. Low- and middle-income households, retirees on fixed incomes, and working families are often mentioned in discussions as potential recipients, but final rules would depend on official legislation.

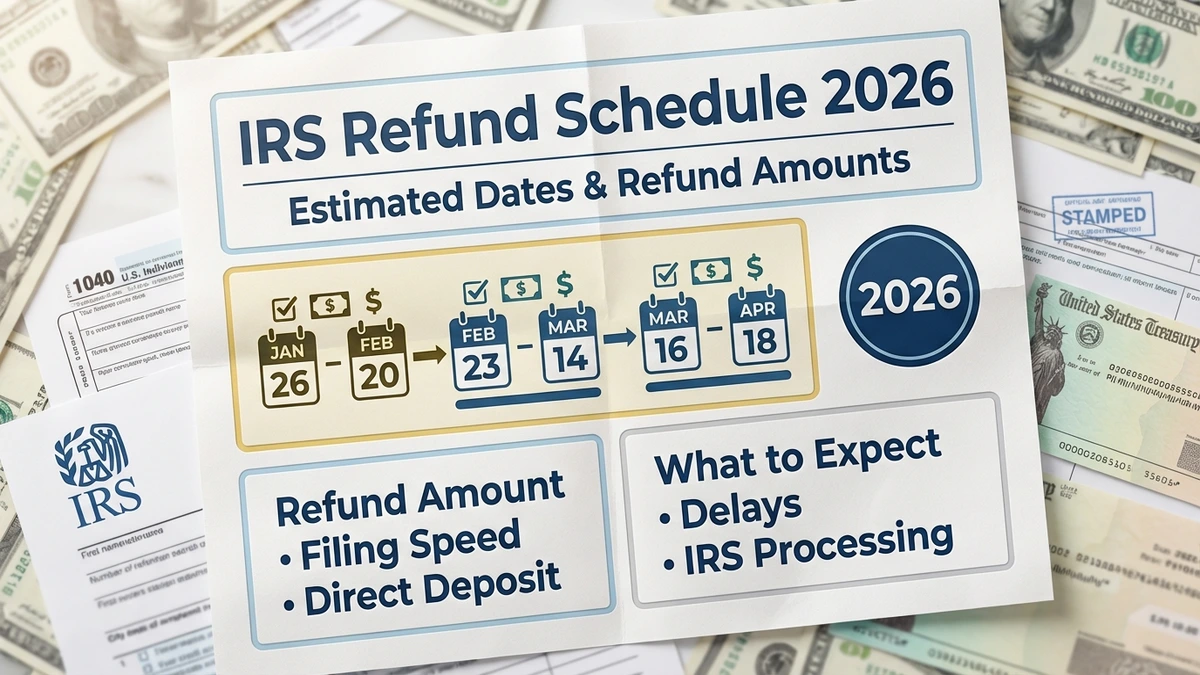

Possible Payment Timing and Delivery

Payments, if authorized, would likely be issued in phases. Direct deposit would be the fastest method, as bank information from recent tax returns could be used. Paper checks or prepaid debit cards might be sent to individuals without electronic payment details, which would take longer to arrive. Updating personal and banking information in advance would help avoid delays.

Setting Realistic Expectations

It is important to remember that the $2,000 direct deposit remains under discussion and has not been officially approved. Financial experts often advise households not to depend on unconfirmed payments when planning budgets. Public reaction and future policy decisions will determine whether such relief measures move forward.

The discussion around a $2,000 IRS direct deposit reflects ongoing concerns about affordability and household finances. Staying informed through official announcements and avoiding rumors remains the best way to stay prepared.

Disclaimer: This article is intended for informational and educational purposes only and does not provide legal, financial, or tax advice. Details related to any proposed IRS payment, including eligibility, payment timelines, and distribution methods, may change based on official government announcements. Readers should rely on official IRS communications or consult qualified professionals for guidance specific to their circumstances.